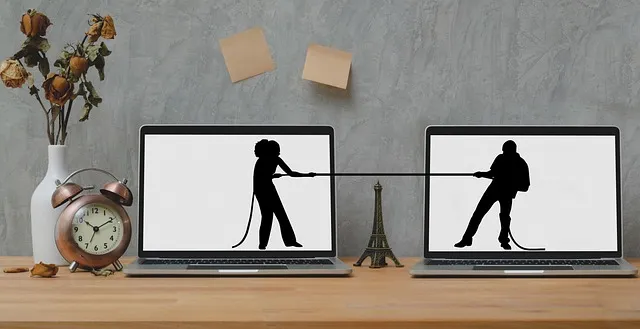

Divorce mediation for high-net-worth executives is a specialized process tackling complex financial aspects of separations, including business interests, retirement savings, and investment properties. Mediators with expertise in these areas facilitate collaborative agreements, focusing on co-parenting plans that balance immediate and long-term financial impacts while addressing parental rights and children's well-being. This approach streamlines the divorce process, avoids costly court battles, and fosters cooperative environments, especially when children are involved, leading to fairer settlements and smoother transitions during emotionally challenging times. Effective communication is crucial, with mediators encouraging open dialogue, active listening, and clear language to navigate complex financial negotiations and related discussions like parental rights and child custody.

Divorce mediation for high net worth couples is a specialized process that requires navigating complex financial matters. When executives are involved, business valuations, retirement plans, and investment properties create unique challenges in settlement negotiations. This article explores the intricacies of such divorces, highlighting the crucial role of mediation in simplifying financial complexities. We delve into business valuations, retirement plan impacts, and strategies for dividing investment properties, offering insights tailored to executives seeking effective divorce mediation.

- Understanding the Complexities of High Net Worth Divorces

- The Role of Divorce Mediation in Simplifying Financial Matters

- Business Valuations: A Critical Component in Executive Divorces

- Retirement Plans and Their Impact on Settlement Negotiations

- Investment Properties: Dividing Assets Beyond Traditional Homes

- Strategies for Effective Communication During Mediation Sessions

Understanding the Complexities of High Net Worth Divorces

Divorces involving high net worth couples present a unique set of challenges that require specialized expertise. These complexities arise from the intricate financial landscape, often including diverse business interests, substantial retirement savings, and investments in real estate or other assets. Effective divorce mediation for executives demands a deep understanding of these financial matters to ensure a fair and equitable division of property.

The process involves careful navigation to create co-parenting plans that consider not just the immediate financial picture but also the long-term implications on both parties’ futures, including their parental rights and the well-being of any children involved. Professional mediators help couples reach mutually agreeable solutions, fostering a collaborative environment while providing parenting agreement help tailored to their unique circumstances. This approach allows for more control and satisfaction in the outcome, promoting a smoother transition during what can be an emotionally charged time.

The Role of Divorce Mediation in Simplifying Financial Matters

Divorce mediation for executives offers a streamlined approach to handling complex financial aspects often associated with high net worth divorces. This specialized process brings together both parties and skilled mediators to navigate business valuations, retirement plan distributions, and the settlement of investment properties. By employing this method, couples can avoid the lengthy and costly battles that often arise in traditional divorce proceedings.

Through mediation, executives can focus on reaching mutually agreeable solutions rather than engaging in bitter negotiations. This not only simplifies financial matters but also fosters a more collaborative environment, particularly beneficial when children are involved. Unlike contentious court cases, mediation allows for flexible co-parenting plans and the negotiation of fair visitation schedules, ensuring the best interests of the family unit are considered without the animosity often seen in divorce proceedings.

Business Valuations: A Critical Component in Executive Divorces

Business valuations play a critical role in divorce mediation for executives, where complex financial arrangements are common. In high net worth divorces, assets often include substantial businesses, which require meticulous evaluation to ensure fair distribution. This process involves analyzing various factors such as market value, future growth potential, and specific industry dynamics. Accurate business valuations are essential for reaching a mutually agreeable settlement, especially when deciding on asset division and spousal support.

Divorce mediation for executives also delves into retirement plans and investment properties, requiring careful consideration during the negotiation process. These assets can significantly impact the financial well-being of both parties post-divorce. Effective mediation strategies involve open dialogue about future co-parenting plans and creating structured visitation schedules, ensuring that these negotiations are as smooth as possible while also addressing the complex financial landscape.

Retirement Plans and Their Impact on Settlement Negotiations

Retirement plans play a significant role in divorce mediation for executives, often complicating settlement negotiations. These assets, accrued over years of dedicated work, can be highly contentious, as they represent security and independence for the post-divorce life of both parties. During mediation, the process of valuing and dividing retirement benefits becomes a delicate dance, requiring expertise to ensure fairness. A qualified mediator understands that each retirement plan is unique, with its own rules and regulations, and can facilitate discussions to reach a mutually agreeable outcome.

In the context of divorce mediation for high-net-worth individuals, retirement plans are not merely financial instruments but complex entities that can impact the overall settlement. As such, they demand meticulous attention during negotiations. The mediator’s role is to help the couple make informed decisions regarding 401(k)s, pensions, and IRAs, considering both the present value and future potential of these assets. This careful navigation ensures that the final agreement respects each spouse’s parental rights and promotes a fair child custody negotiation, taking into account the best interests of any children involved.

Investment Properties: Dividing Assets Beyond Traditional Homes

In divorce mediation for executives, the division of assets extends far beyond traditional homes and savings accounts. Investment properties, a significant aspect of high net worth marriages, require meticulous attention during the mediation process. These properties often include commercial real estate, rental properties, or even investments in startups, each with its own unique valuation challenges. Mediators must possess expertise in financial analysis to ensure a fair split, considering market trends, potential rental income, and future profitability.

For high-asset couples, dividing investment properties requires careful consideration of not only the present value but also future prospects. This process involves intricate negotiations regarding property management, tenant relationships, and any existing partnerships or businesses associated with the investments. Moreover, as these assets may be tied to parental rights mediation or child custody negotiation, co-parenting plans must be strategically aligned with the settlement to ensure stability for all involved parties.

Strategies for Effective Communication During Mediation Sessions

Effective communication is key to successful divorce mediation for executives, where complex financial matters and valuable assets are at stake. High-net-worth couples often have different perspectives on their shared wealth, so mediators must encourage open dialogue. Active listening is a powerful tool; each party should feel heard and understood, enabling them to express their needs and concerns without fear of judgment. This creates an environment where sensitive topics like business valuations, retirement plans, and investment properties can be discussed openly, fostering collaboration rather than confrontation.

During mediation sessions, clear and concise language should be used to explain intricate financial concepts, ensuring both partners grasp the implications. Mediators can facilitate this by providing simple explanations, offering examples, and encouraging questions. Moreover, addressing emotional aspects is vital; these negotiations can be highly charged, so recognizing and managing emotions allows for more rational decision-making. This strategic approach to communication not only streamlines the mediation process but also helps executives navigate their parental rights mediation, child custody negotiation, and parenting agreement discussions with clarity and mutual respect.